Chapter 2 - Summary of suggested changes

2.1 Below is a summary of officials’ suggestions for the design of the bright-line test.

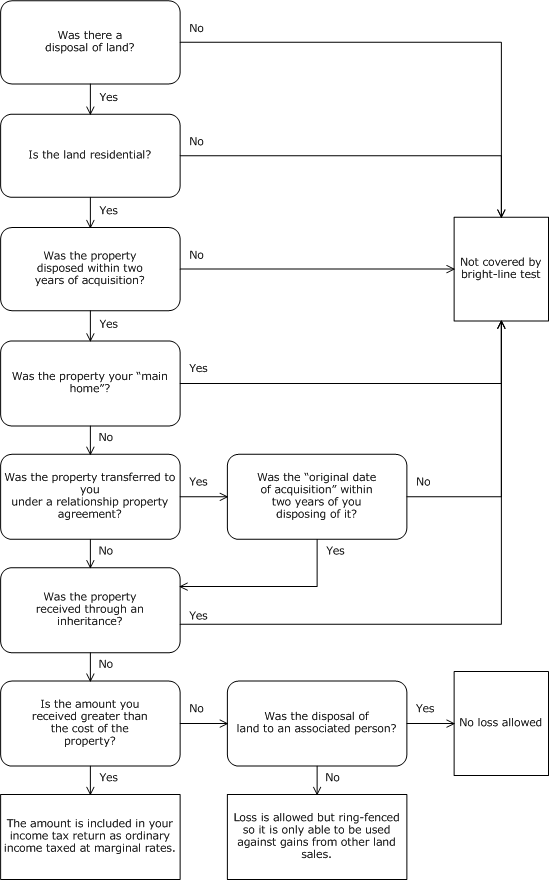

Acquisition date and disposal

2.2 The two-year period for the bright-line test runs from the date of acquisition to the date of disposal. The date of acquisition is the date that title is registered for the purchase of the property and the date of disposal is the date that a person enters into an agreement for sale and purchase for the sale. When the disposal is other than by sale (for example, a gift), the date of disposal will be determined under the ordinary rules.

2.3 If disposal occurs before registration[1] (sales of the right to buy), the bright-line period runs from the day that a person enters into an agreement for sale and purchase (for the purchase of the right) to the date that a person enters into an agreement for sale and purchase (for the sale of the right).

2.4 The suggested bright-line test will apply to properties for which an agreement for sale and purchase is entered into from 1 October 2015, and which is subsequently disposed of. When the property was acquired other than by way of sale, the suggested bright-line test will apply to properties for which registration of title occurs after 1 October 2015.

Definition of “residential land”

2.5 Under the suggested changes, residential land means:

- land that has a dwelling on it; or

- land for which there is an arrangement to build a dwelling on it;

- but does not include land that is used predominantly as business premises or as farmland.

2.6 Farmland is land where the area and nature of the land disposed of means that it is then capable of being worked as an economic unit as a farming or agricultural business.

Main home exception

2.7 Under the suggested changes, the main home exception will apply when the land has a dwelling on it and the dwelling is occupied mainly as a residence and is the main home of:

- the owner; or

- if the owner is a trustee, one or more beneficiaries of the trust.

2.8 If a settlor of a trust has a main home that is not owned by the trust, the main home exception cannot apply to any property owned by the trust.

Exceptions for relationship property and inherited property under the suggested changes

2.9 Under the suggested changes, inherited property is excluded from the bright-line test. This means no tax liability under the bright-line test would arise for the transfer of property under an inheritance, and the beneficiary would not be liable under the bright-line test for any subsequent disposal of the property.

2.10 Transfers of property under a relationship property agreement would not be subject to a tax liability under the bright-line test. However, any subsequent sale of the transferred property may be subject to the bright-line test. A liability would arise if the property is disposed of within two years of the registration date on the acquisition by the transferor (and the property was not the transferee’s main home).

Deductibility of expenditure

2.11 Taxpayers would be allowed deductions for property subject to the bright-line test according to ordinary tax rules.

Losses

2.12 Losses arising only as a result of the bright-line test would be ring-fenced so that they may only be used to offset taxable gains arising under the land sale rules. As is currently the case, losses would not be ring-fenced if they are taxable under another land sale rule.

2.13 A person would not be able to recognise a loss under the bright-line test arising from a transfer of property to an associated person.

Land-rich companies and trusts

2.14 The use of land-rich companies and trusts to circumvent the bright-line test would be addressed through an anti-avoidance rule that deems a disposal subject to the bright-line test to have occurred if any of the following are done with the purpose or effect of defeating the intent and application of the suggested bright-line test:

- the disposal of shares;

- a change in the trustees of a trust;

- a change in the beneficiaries of a trust;

- a change in the identity of any person who is able to appoint the trustee or the beneficiaries of a trust; and

- a change in the ownership of a corporate trustee.

1 Including what are commonly referred to as sales “off the plan”.